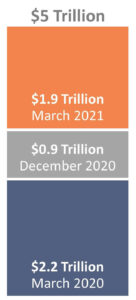

Yesterday, President Biden signed into law the lastest COVID relief bill in an effort to help the economy recover from the effects of the pandemic. The $1.9 trillion stimulus package will bring total COVID relief measures to $5 trillion, which all told will add a whopping 20% to U.S. public debt.

The combination of rising national debt, pent up demand, and continued monetary and fiscal stimulus are stoking fears of inflation. Some market observers are preparing for the possibility that “Goldilocks is dead.”

Goldilocks Economy

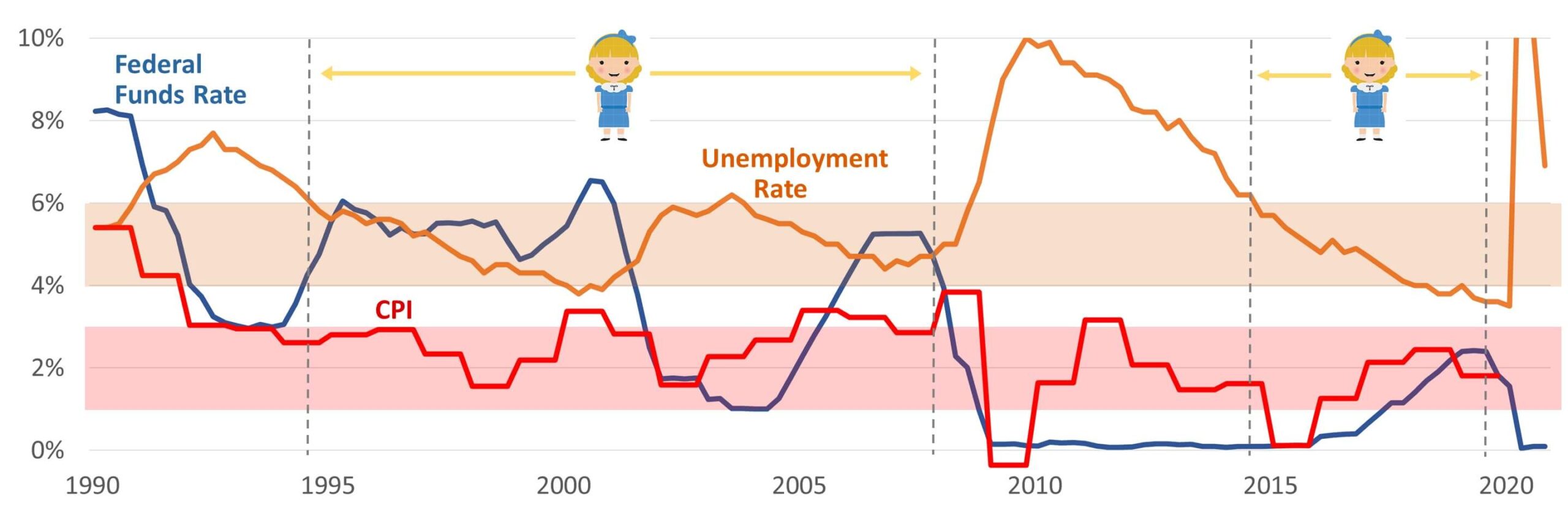

A Goldilocks economy – one that is neither too hot nor too cold – achieves an ideal balance between strong employment, stable prices, and sustainable growth. The U.S. has enjoyed the relatively stability of a Goldilocks economy for much of the past 25 years.

The chart below gives a sense of just how much of recent history could be described as a Goldilocks economy. With the exception of the Great Recession and the recent COVID shock, relative equilibrium has become the ‘new normal’.

.

In the chart below, the shaded pink band highlights a range of price stability, where CPI is in the 2% range. The orange band shows a range of 4%-6% unemployment, which for presentation purposes acts as a rough gauge of an employment market that is strong but not inflationary.

..

A Just-Right Mix | CPI & Employment

Data Sources: FRED Economic Research – Federal Reserve Bank of St. Louis; U.S. Bureau of Labor Statistics,

Board of Governors of the Federal Reserve System; World Bank. Graphics by Admiral Real Estate.

.

Because the U.S. hasn’t experienced sustained annual inflation above 3% for 30 years, roughly half of the country’s population does not have a significant inflationary period within their living adult memory. For those of us who do, it is easier for us to recall from experience why avoiding excessive inflation is one of the Federal Reserve’s primary goals.

Dual Mandate

Although the term ‘Goldilocks’ is not officially in their mission statement, the goal of the Federal Reserve is to use monetary policy to support a stable economy by doing two things: maintain price stability and encourage maximum sustainable employment.

THE FED’s DUAL MANDATE:

1 – Stable Prices

2 – Maximum Sustainable Employment

.

When unemployment is high and the Fed would like to spur the economy to encourage job creation, the Fed targets lower interest rates. When the Fed wants to cool an overheating economy to promote price stability, they use higher interest rates to slow growth.

The dual mandate requires a delicate balancing act of supporting a relatively high employment rate, but not so high as to trigger a jump in inflation.

The Fed has explicitly stated that they target a 2% inflation rate over the long term, but their target for maximum sustainable employment is not as clearly defined. For the purposes of discussion and the ‘Goldilocks’ chart above, we used a range of 4%-6% unemployment. But the actual rate the Fed feels reflects maximum employment without overheating the economy depends on a complicated set of shifting dynamics.

Here is how the Fed describes some of the variables when assessing maximum sustainable employment:

Given the dynamic nature of the economy, it is not possible to know exactly how low the unemployment rate may be able to fall in a sustained way without causing excessive inflation. The lowest level of unemployment that the economy can sustain changes over time as the jobs market changes. For example, employers may use new ways to search for workers, and workers may use new ways to find jobs. Even in good times, a healthy, dynamic economy will have at least some unemployment as workers switch jobs, and as new workers enter the labor market.

Federal Reserve Chair Jerome Powell recently indicated that he feels it will take time for the U.S. employment market to recuperate, so it is too soon to raise its target rate.

Inflation Fears

Given the complexity of the Fed’s mandate, it is no surprise that there are conflicting opinions as to appropriate courses of action for the Fed.

Although employment is poised to grow significantly in 2021 and 2022 along with the economy, the Fed does not intend to tighten monetary policy in the near term to ward off inflation. Federal Reserve Chair Jerome Powell’s priority seems to be on increasing employment. He commented that even if employment sooner than expected, upward movements in inflation are likely to be temporary.

Not all market observers feel so sanguine. The huge build-up in U.S. debt, when combined with a growing economy and continued expansionary monetary policy, has stoked fears of inflation.

$5 Trillion of New Debt

Pre-COVID, the national debt stood at $23 trillion. Including the recently enacted $1.9 trillion American Rescue Plan, 2020-2021 COVID relief packages have, in less than two years, added an astonishing $5 trillion to U.S. debt, effectively increasing debt levels by 20%:

By comparison, the American Recovery and Reinvestment Act of 2009 committed $825 billion in reaction to the 2008 financial crisis.

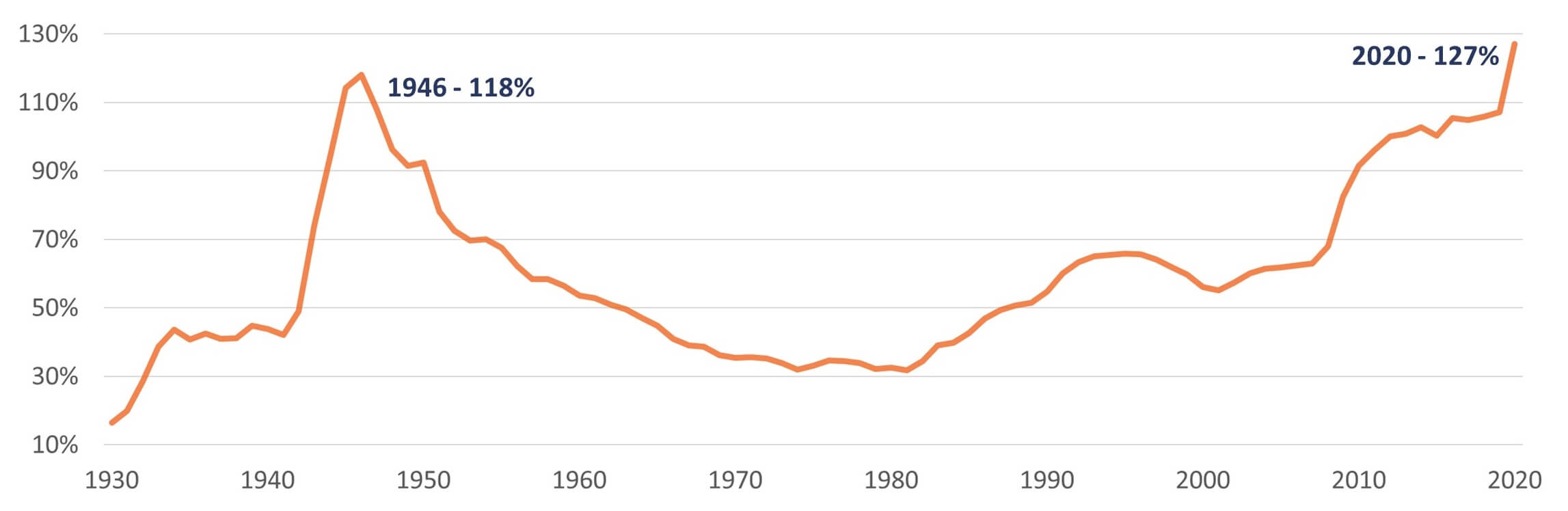

The COVID relief funds have increased debt as a percentage of GDP to 127%. This is a historically significant level, higher than the debt to GDP ratio following World War II, which peaked at 118% in 1946.

Data Source: Federal Reserve Bank of St. Louis (Debt as % of GDP). Graphics by Admiral Real Estate.

.

If increasing national debt pushes inflation higher, the U.S. could have a difficult time returning to pre-COVID price stability. Other potential inflationary pressures add to those worries, including the past year’s high level of accumulated savings and pent-up demand for goods and services, combined with supply constraints precipitated by COVID.

Deflationary Pressures

Household savings jumped from 7.5% in 2019 to 16.0% in 2020[i], as uncertainty and fear caused consumers to hold back spending. No one is sure how quickly Americans will begin to spend again. If spending comes roaring back, inflationary pressures will mount. But demand, and the specter of inflation, would diminish if consumers continue to be cautious, personal tax burdens increase, or unemployment remains stubbornly high. Artificial intelligence, robotics and automation are among the long-term transformations that could depress job growth. Demographic trends such as the graying of the population could also dampen demand over time.

“I Vote for Inflation”

A year ago, we wrote a blog comparing economists’ predictions relating to inflation, deflation and stagflation post-COVID. After reading the blog, one of our clients told us, tongue-in-cheek, “I vote for inflation.”

Although they were kidding on the square, if we are unable to resurrect Goldilocks, that preference really does make some sense. Stagflation and deflation can be even more intractable and difficult to counter.

We vote for inflation, too, as long as it’s Jerome Powell’s version of Inflation Lite.

.

Admiral Real Estate Services Corp. is a commercial real estate brokerage firm offering agency leasing, site selection and investment sales services. Admiral currently lists and/or manages over 100 retail, office and development properties in the New York metropolitan area, specializing in Westchester County, NY, Fairfield County, CT and Bronx County, NY.

[i] Federal Reserve Bank of St. Louis – Personal Saving Rate (PSAVERT).