About Us

EXCELLENCE IN COMMERCIAL REAL ESTATE BROKERAGE DRIVEN BY A UNIQUE COMBINATION OF STRENGTHS

Investment Sales

Agency Leasing / Landlord Representation

Office & Medical Tenant Representation

Retail Site Selection

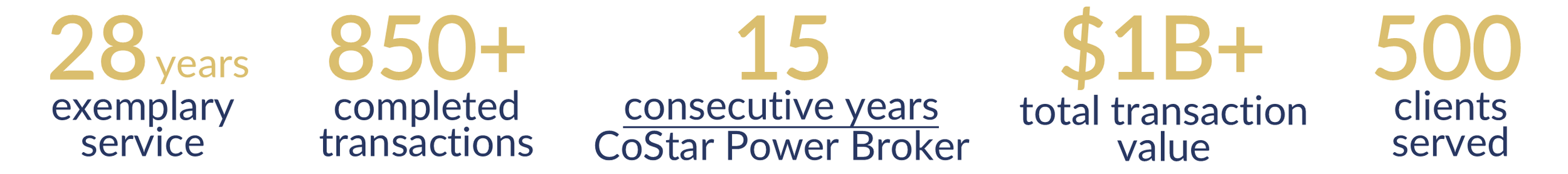

NY Metro Area Specialists | For 28 years, Admiral Real Estate Services Corp. has been hyper-focused on our Westchester, Fairfield & Bronx County commercial real estate markets.

Extensive Network | Our team maintains uncommonly strong, long-term industry relationships sustained by years of experience and a reputation for ethics, hard work & positive results.

Deep Local Market Knowledge | Decades of exclusive focus on our local markets affords us historical perspective on the dynamics influencing each market. An essential part of our work is continually gathering real-time market intelligence.

Unmatched Client Support | Our team custom-designs compelling marketing materials & maximizes exposure through industry web sites, proprietary lists, targeted email campaigns & door-to-door canvassing. We pride ourselves on consistent communication and straightforward, honest insights & recommendations.

Superior Research & Analytics | Admiral provides clear, intelligible proformas, comparisons & market data to help you assess your strategic options. We won’t throw a thick pile of papers at you. We critically assesses market data and pare it down to the most relevant material.

Team

Clients

Admiral is focused on building long-term relationships.

The proof is in our client retention; many of our clients have been with us for over a decade.

Successes

Providing superior commercial real estate services in the Westchester, Fairfield & Bronx county markets since 1997.

Giving Back

In order to give back to our local & global communities, Admiral supports a wide range of causes, such as hunger and poverty relief, community development, environmental preservation, emergency response and arts & education.