We’ve received a lot of questions from clients about possible investments in Opportunity Zones. Many have found the OZ program difficult to deconstruct, from what the incentives actually are to how they can be utilized. We wrote this summary to help give real estate investors the basic framework, with examples for further clarification.

__________________________________________________________________________________________________________.

Please note that Admiral does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on, for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

.

..

BACKGROUND | Spurring Economic Development

The Tax Cuts and Job Acts of 2017 included the Opportunity Zone community development program, created to spur economic development in lower income areas around the United States. In exchange for long-term capital investment in an Opportunity Zone, investors benefit from deferral of taxes on gains. The gains can be from almost any type of investment – such as sale of a business, stock, bond or real property – and can be short- or long-term.

To defer gains, an investor must invest in a qualified Opportunity Zone fund, which holds at least 90% of its assets in qualified Opportunity Zone property, within 180 days of the initial gain.

KEY ADVANTAGES | Reducing Capital Gains Taxes

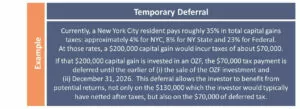

The tax advantages to investing in a qualified OZ fund (“OZF”) revolve around deferring, and ultimately reducing or eliminating, federal taxes on capital gains. Although not all states are following along, New York State generally allows the same benefits to state taxes on capital gains.

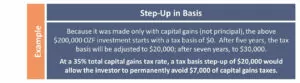

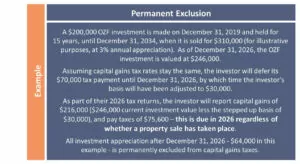

Tax benefits are accomplished in three ways: temporary deferral of capital gains taxes, a step-up in basis for properties held 5 years or more, and permanent exclusion of appreciation realized after December 31, 2026.

- Temporary Deferral. OZF investors can defer taxes on capital gains through the earlier of (i) the sale of the OZ property and (ii) December 31, 2026.

.

. - Step-Up in Basis. If the OZF investment is made by contributing only capital gains (no principal), the OZF investor’s tax basis is $0. If the OZF investment is held for 5 years, that basis is stepped up to 10% of the investment. If held for 7 years, the basis increases to 15%.Since the end date of deferrals is December 31, 2026, an initial OZF investment would need to be made on or prior to December 31, 2019 in order to receive the maximum 15% step-up in basis.

.

. - Permanent Exclusion. If an investor holds the OZF investment for 10 years or more, capital gains on appreciation realized after December 31, 2026 is permanently excluded.

.

.

.

DIFFERENCES | Between OZFs + 1031-Exchanges.

- Investments in qualified Opportunity Zone funds can shelter capital gains from almost any kind of investment, whether from a business sale, stocks, bonds or real estate. In ‘like-kind’ 1031-exchanges, only gains from real estate investments can be sheltered.

. - The amount of an OZF investment can be limited to the amount of the gain itself; it does not need to include the amount of the initial principal. In 1031-exchanges, the value of the new property(ies) purchased must be equal to or greater than the amount of the initial investment plus the subsequent capital gain.

.

. - There is the possibility of permanent elimination of capital gains taxes with OZF investments which is not available through 1031-exchanges.

.

CRUCIAL DETAILS | Investment Parameters

To qualify for OZ tax benefits, investors must follow several key requirements, such as investing their capital gains within 180 days, and only through a qualified fund. Furthermore, the qualified fund must maintain 90% of capital in OZ properties and must make significant capital investments in those properties within 30 months of purchase.

…

- Investments must be made within 180 days of receiving a capital gain.

. - OZF investments can only be made through a qualified opportunity fund which holds a minimum of 90% of its assets in Opportunity Zone property. Some opportunity funds own multiple OZ properties, while others are single-asset entities created to invest in a particular OZ property.

.

. - Opportunity funds must maintain the 90% test, or they will incur financial penalties from the government. Maintaining this 90% minimum might get complicated with some multiple property opportunity funds, because of the likelihood of staggered purchase and sale dates. In contrast, this benchmark is much simpler test with single-asset opportunity funds.

.. - In keeping with the ultimate goal of spurring economic development, OZ investments must include significant investments into the property within 30 months, adding, at a minimum, improvements equal to the original building value, not including land.

.

.

.

RETURNS | Standard Investment vs. OZF Investment.

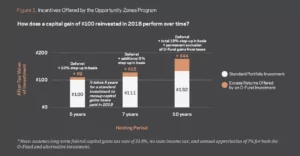

In their fact sheet Opportunity Zones: A New Incentive for Investing in Low-Income Communities, the Economic Innovation Group (EIG) offered the below comparison of how a gain of $100 would perform in a standard investment versus an OZF investment:

.

SOURCE: EIG – “Opportunity Zones: A New Incentive for Investing in Low-Income Communities”

SOURCE: EIG – “Opportunity Zones: A New Incentive for Investing in Low-Income Communities”

_________________________________________________________________________________

Please note that Admiral does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

_________________________________________________________________________________

Check back soon for maps of each of Westchester’s opportunity zones.

.

For our on-market investment properties located in OZs, see AVAILABILITIES

.

.For more information, contact Jonathan Gordon, President/CEO or call 914.779.8200 x115

.

Admiral Real Estate Services Corp. is a commercial real estate brokerage firm offering retail leasing, site selection and investment sales services. Based in Westchester, the company currently lists and/or manages over 100 retail, office and development properties in the New York metropolitan area.

_________________________________________